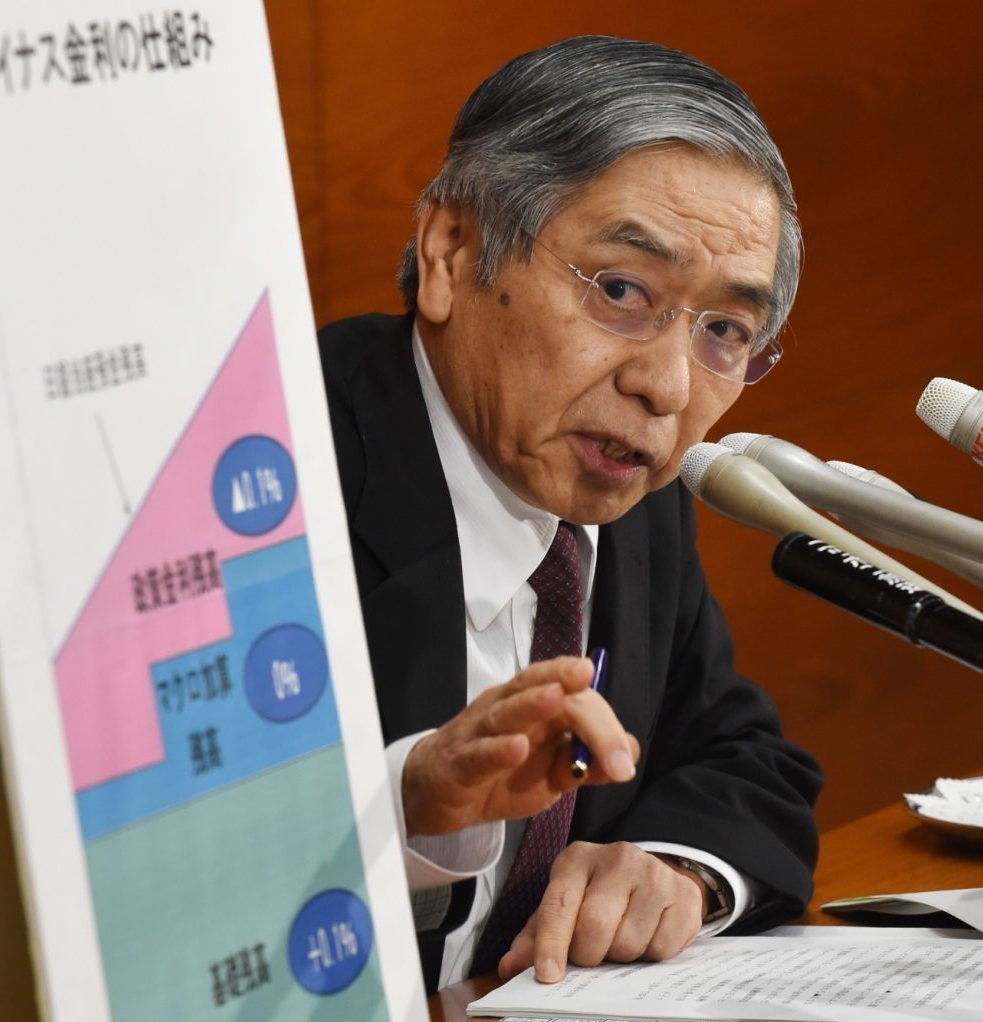

Last throw of the dice: Japan boosts world markets with negative interest rate

Japan’s central bank has given surprised world markets a shot in the arm by introducing a negative deposit rate for commercial banks. The unexpected move, which means that banks, in effect, have to pay to hoard cash, is intended to stimulate spending. It is hoped it will force banks to lend more money to customers and encourage them to spend. The tactic injected some life into stock markets, with the Nikkei 225 in Tokyo closing 2.8% higher on Friday, although the gains were tentative. Stocks were up elsewhere in Asia and in Europe while the dollar surged, too.

As long as the economy is shaky and the world is burdened with high debt, central banks and their money-printing machines are a necessary evil to keep up the markets.

KBC senior economist Koen De Leus

Japan’s economy has stalled with inflation stagnating as shoppers appeared unwilling to spend. The BoJ had already kept its key interest rate at near zero as part of the country’s easy money policy – a key weapon in prime minister Shinzo Abe’s “Abenomics” economic revival programme. The latest policy shift is similar to a tactic employed by the European Central Bank for the eurozone last year. But some see it as a desperate measure and a sign other tactics are failing. "It was a surprise to most market players who thought negative interest rates would be a last resort,“ said Koichi Fujishiro, senior economist at Dai-ichi Life Research Institute.

bank of japan