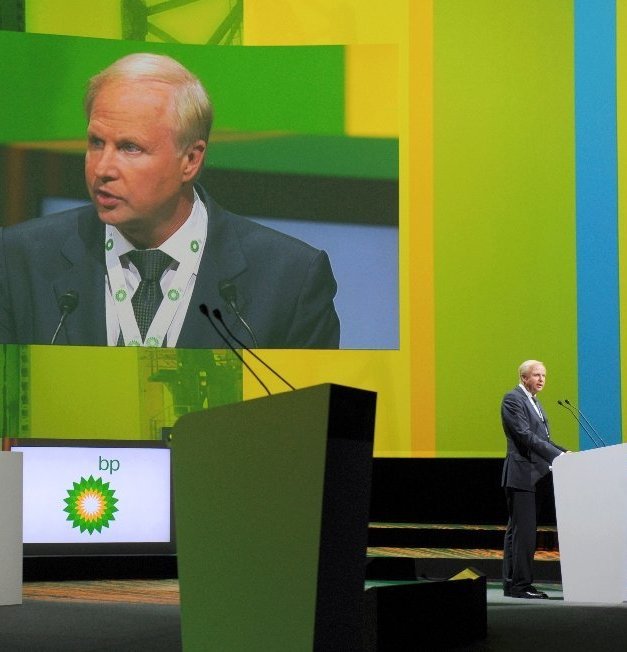

Shareholders slap down BP board over $20m pay deal for ‘fat cat’ chief executive

Shareholders in oil giant BP gave the company’s board a symbolic slap in the face today when they voted to reject a $20 million pay deal for chief executive Bob Dudley. Almost 60% of shareholders rejected a remuneration report, which proposed increasing Mr Dudley’s pay package by 20%, despite the group posting its largest annual loss for 20 years and axing thousands of jobs worldwide. The vote was only advisory as shareholders have no power to veto it and Mr Dudley has already been paid. But experts said it was one of the largest ever votes against a fat cat pay deal.

We think it sends the wrong message. It shows that the board is out of touch.

Ashley Hamilton Claxton, corporate governance manager at Royal London

The unexpected vote came after BP chairman Carl-Henric Svanberg told the company’s annual general meeting Mr Dudley deserved the rise because he had put in a “seriously impressive performance”. In his opening address, he acknowledged shareholders’ concern during a grim year of falling oil prices but said pay would not be judged on bottom line profit but on “measures that are clearly within management’s control”. He added: “The board has concluded that it has been an outstanding year. The pay reflects this and it is consistent with our policy.” Although shareholder group Sharesoc branded the pay deal as “simply too high”, it had been expected to go through at the meeting.

Let me be clear. We hear you. We will sit down with our largest shareholders to make sure we understand their concerns and return to seek your support for a renewed policy

BP chairman Carl-Henric Svanberg

bob dudley